Maximum Profit Sharing Contribution 2025. The 2025 limits are contained in notice 2025. One’s investment strategy in a 401 (k).

The 401 (k) contribution limit for individuals has been increased to $23,000 for 2025. Family coverage will increase from $7,750 to $8,300.

The 401 (k) contribution limit for 2025 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions.

Singles and heads of household who earn up to $161,000 in 2025 may contribute to a roth ira, although the maximum contribution will begin to phase out.

profit sharing plans for small businesses Choosing Your Gold IRA, The basic limit on elective deferrals is $23,000 in 2025, $22,500 in. The dollar limitations for retirement plans and certain other.

401(k) Contribution Limits in 2025 Meld Financial, 401 (k) pretax limit increases to $23,000. Appropriation of total profit and distribution of ordinary dividend out of total profit and capital contribution reserve.

profit sharing plan maximum contribution 2025, The dollar limitations for retirement plans and certain other. However, for 2025, this limit has increased to $23,000, allowing individuals to contribute an additional $500 toward their retirement savings.

Hsa Limits 2025 Rycca Clemence, The basic limit on elective deferrals is $23,000 in 2025, $22,500 in. Morgan professional to begin planning your 2025 retirement contributions.

Best Guide to 401k for Business Owners 401k Small Business Owner Tips, Earnings limit for people in the. One’s investment strategy in a 401 (k).

What Is The Ira Contribution Limit For 2025 a2022c, This amount is an increase of. Family coverage will increase from $7,750 to $8,300.

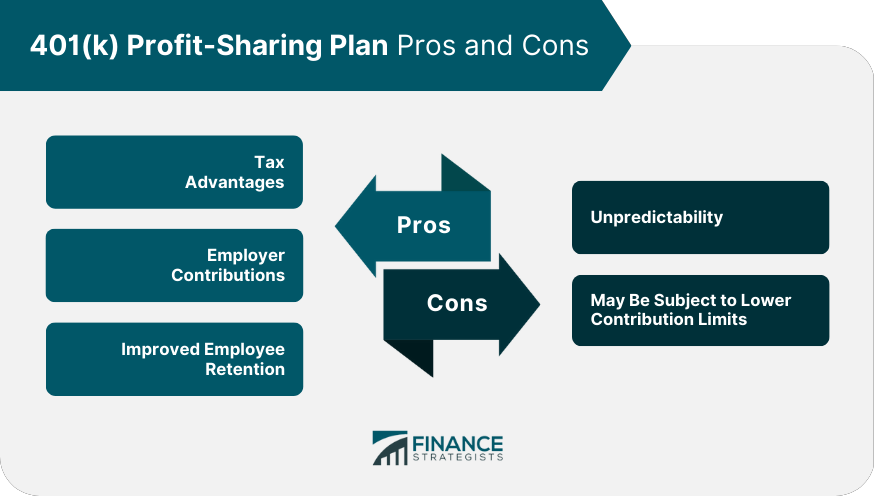

The Many Benefits of 401(k) ProfitSharing Plans Corporate Tax Return, If you opt for the maximum allowed. The 401 (k) contribution limit for individuals has been increased to $23,000 for 2025.

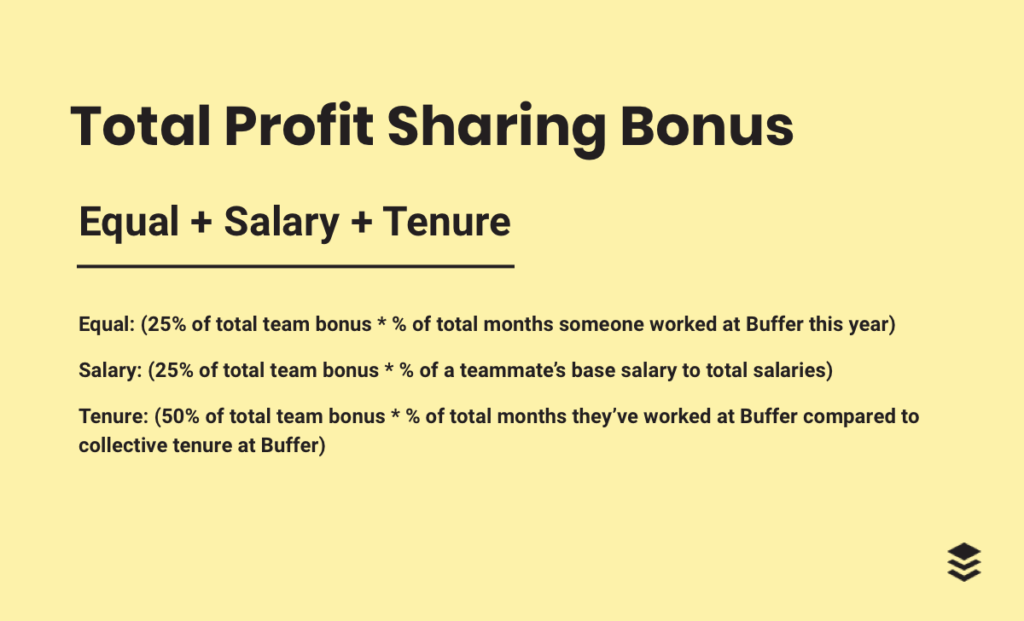

401(k) ProfitSharing Plan Definition, Benefits, & Drawbacks, The maximum limit contribution for a profit sharing plan is capped at the lower of either $69,000 or 25% of an employee’s salary for 2025. The 2025 limits are contained in notice 2025.

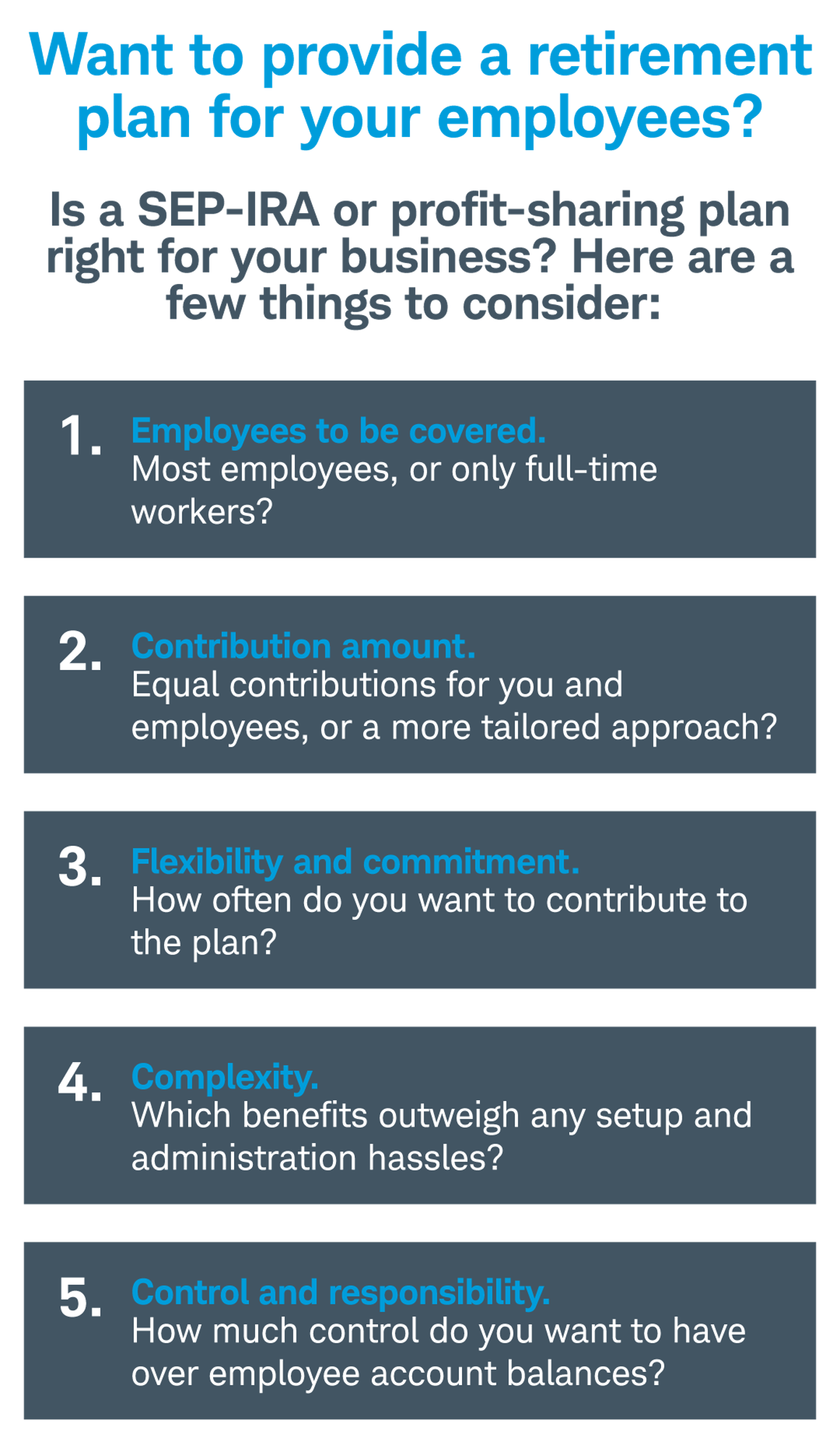

SEPIRA vs. ProfitSharing Plan 5 Small Business Con… Ticker Tape, Family coverage will increase from $7,750 to $8,300. Employees can contribute the maximum permissible amount to their epf account, i.e.

profit sharing payout rules Choosing Your Gold IRA, Check with your employer for. The maximum limit contribution for a profit sharing plan is capped at the lower of either $69,000 or 25% of an employee’s salary for 2025.

Earnings limit for workers who are younger than full retirement age (benefits reduced $1 for each $2 over the earnings limit) $21,240: